Contents

When price reaches the overbought level, traders anticipate a reversal in the opposite direction and sell. Similarly, when price approaches the oversold level, it’s considered a buy signal. Finally, if price breaks through this established range, it may be a sign that a new trend is about to take shape. These include day trading, swing trading, scalping, position trading, and trend following. A trader usually chooses a strategy that suits their trading style and risk appetite. But at the same time, we can sell the whole GBP crosses to spread our risk evenly across multiple currency pairs.

It also gives you the opportunity to include fundamental analysis – which is futile to do when scalp trading. The financial markets are evolving constantly, and traders must evolve with them. Like the Bollinger band indicator, the Keltner Channel uses two boundary https://traderoom.info/ bands – constructed from two ten-day moving averages – either side of an exponential moving average. Traders can use the channels to determine whether a currency is oversold or overbought by comparing the price relationship to each side of the channel.

If you want to start trading forex right away or are looking for a better online broker to partner with, check out Benzinga’s top picks for forex brokers in the table below. As an example of what to look for in a good forex broker, you can check out Benzinga’s FOREX.com review. Traders who choose avoid this fatal trading mistake this type of trading style need patience and discipline. It might take days for a quality opportunity to show up, or you might end up holding a trade open for a week or more while running an open loss. Some traders do not have the necessary patience, and close their trades too early.

Forex day trading

The Stochastic oscillator might work better with a length of 9. To backtest, you would write down at what price you would’ve entered, your stop loss, and your exit strategy. A currency index is an index that measures the value of one currency against a basket of foreign currencies. Most traders are only familiar with the US dollar index DXY, but the reality is that you can construct an index for the GBP, EUR, JPY, and other currencies. After the first trading day, the sum of all of our positions would be -50 pips. The results are pretty disappointing, but let’s consider moving forward and see what would happen after 10 days.

These are covered below based on the typical time involved, ranging from short to long term. The majority will spend a significant amount of time testing various strategies with a demo trading account and/or backtesting. This allows you to conduct your tests in a safe and risk-free environment. Momentum indicators can be a useful tool when providing overbought and oversold signals. Forex traders can use it to identify the strength of the market movement, and whether the price is moving up or down. Trading small breakouts that occur over a short time period has high profit potential.

There must orange line of Trend Envelopes at the signal candlestick. Put together a trading plan that lays out an appropriate position sizing method and clear risk parameters. You can devise a trading plan and practice using it in a demo account. If you prefer to use someone else’s plan and copy trades, then you will need to open an account with a broker that includes a social trading platform. When you’re ready to begin, visit the broker’s website to open up a demo account so that you can start to practice trading and learn how to use its trading platform. If you feel confident in your strategy and the broker you chose, then you can open up and fund a live account to start trading with real money.

It is good if the next following candlestick is bigger than the previous one. The additional line of the DSS of momentum at the signal candlestick should be green. Linear Weighted Moving Average serves here as an additional filter. As the LWMA attaches more importance to the most recent price moves, there are almost no delays in the long-term timeframes.

Most of the time, you’ll notice this chart pattern popping a lot of the time in the middle of the trend or in a sideways market where a lot of price manipulation happens. Now, before we reveal the better way to trade the engulfing pattern trading strategy, it’s important to understand what’s going on behind the scene. Traders who are planning to use the h4 forex trading strategy need to have the correct New York closing charts. The 4-hour time frame is an intraday TF where each corresponding candle encompasses exactly 4 hours of trading activity from open to close. The 4h chart also comes as the standard default time frame with most top trading platforms so, it’s readily accessible. A lot of the time the unemployment numbers can have an impact on the long-term trends.

So, if you planned to only risk 4% on the USD/JPY trade, now that you have 4 currency pairs all aligning up, you can risk 1% on each currency pair individually. Instead of trading one currency, you focus on a basket of currency pairs. You need to know when it’s time to get in and when it’s time to get out if you want to be a successful trader.

Once the trend manifests, it’s important to close out pending orders in the opposite direction so as not to compile interest on positions that aren’t profitable. Trading the dips and surges of ranging markets can be a consistent and rewarding strategy. Because traders are looking to capitalize on the current trend rather than predicting it, there is also less inherent risk. Oftentimes, an asset will remain overbought or oversold for an extended period before reversing to the opposite side. To shoulder less risk, traders should wait to enter into a new position until the price reversal can be confirmed. A forex trading bot or robot is an automated software program that helps traders determine whether to buy or sell a currency pair at a given point in time.

Consumer Price Index (CPI)

To help with the math, try the forex trading position size calculator tool. As soon as the price touches a weekly Fib level, you are now in the “waiting for signal” mode. In other words, the criteria have lined up for you to make a trade, now all you need is the signal to confirm your forecast. As I Casey Stubbs looks at this I truly believe that this is the best strategy for long-term trading that you can learn. I recommend you test it out and then let us know in the comments how it works for you. I believe that one of the big issues with Forex traders today is that they are so caught up in short-term trading and scalping.

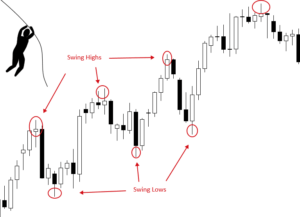

Swing traders tend to focus on entering and existing positions based on momentum indicators that provide buy and sell signals. Traders use them to find overbought or oversold markets they can sell or buy. Swing traders might also buy ahead of support or sell before resistance levels that develop on the charts of the exchange rate for a currency pair. Similar to analysing support levels, forex traders also analyse resistance levels. The resistance level is a point where the market turned from its previous peak and headed back down. If a market is appreciating but then suddenly falls, the overall view is likely to be that the price is getting too expensive.

Conversely, if the next trading day, we break below Friday’s low there is a pretty high chance the pair will be bearish for the entire month. You need to be careful during the NFP forex event because a lot of the time your position might be whipsawed and get stopped out. That’s why you need to prepare to face different market scenarios. You can also check out our blog on the safest options strategy.

Now, you can see how Trump’s tweets can drive the stock market, so it’s important to pay close attention if you really want to capitalize on these trading opportunities. Every major money manager in the world uses those moving averages to make informed decisions about their portfolios. If you’re serious about trading, you need to use forex charts with the New York close. To resolve this issue, and have a more accurate representation of each trading session we use the New York close time to define when a new 4h candle is printed. If by the first half of the day our position shows a loss, we close that trade and call it a day. Based on our backtesting result, on average your trades should reach the second target within 1-3 days.

This strategy is based on the principle that it is better to cut small losses quickly and let large gains run, to maximize the overall profitability of the trading account. Don’t try to manage the trade or get fancy, just trust the strategy and let the trade be a winner or a loser. Trading is all about Math—a good strategy has winners and losers, but at the end of the year, the winners outweigh the loser.

Where can I trade currencies on the forex market?

Even though you can easily customize the default interface of the cTrader platform has a professional design that can cover almost all your trading needs. Unlike other trading platforms, cTrader is a very stable platform that rarely freezes which is something that all trading platforms should strive for. You need a reliable and stable trading platform that doesn’t go offline the moment you open a trade. Furthermore, it’s crucial to have a secure trading platform that can offer you a transparent trading environment.

- As a matter of fact, we believe most traders are better off learning to trade and invest in stocks instead.

- Being a consistent trader, it’s not a one-time event; it has to be a habit.

- In this guide, you’ll learn a mean reversion trading strategy with some trading secrets that will assist you to limit the downside.

- Unlike other breakout trading strategies, however, grid trading eliminates the need to know what direction the trend will take.

- A pip is the smallest price increment tabulated by currency markets to establish the price of a currency pair.

- A forex trading strategy helps to provide traders with insight into when or where to buy or sell a currency pair.

When acquiring our derivative products you have no entitlement, right or obligation to the underlying financial asset. AxiTrader is not a financial adviser and all services are provided on an execution only basis. Information is of a general nature only and does not consider your financial objectives, needs or personal circumstances.

List of trading strategies

A bullish breakout occurs when the price break above the trendline. With the right indicators in place, and equipped with strong Forex trading strategies, catching profitable trends will be no arduous task. If you want to find the best Forex strategy ever, you should create it yourself. Change indicators’ settings, test different technical tools, and trade on various timeframes. Try a free demo account at FXOpen to develop your effective Forex strategy.

When it comes to the protective stop loss we’re advising not to place a stop loss right away, but instead, use a time stop. The second portion of your position is left until we break and close above the 10-period SMA. There are a variety of indicators that calculate in some form or other extreme and unusual price movements. High win rate – the shorter the mean reversion time frame used the higher the win rate. Obviously, there is also a probability that the price will not revert back to its mean. This can indicate that there is a real shift in the market sentiment and we’re in a new paradigm.

EFFECTIVE FOREX TRADING STRATEGIES

When choosing a forex trading strategy, it helps to be aware of what type of trader you are and what types of strategies exist. However, it is not as simple as selecting a single trading strategy, as traders can choose to employ a single strategy or combine several. Spread bets and CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money.

Important legal documents in relation to our products and services are available on our website. You should read and understand these documents before applying for any AxiTrader products or services and obtain independent professional advice as necessary. So it’s up to you to compare the infoinvesting strategies which may be better suited. However, you should also be familiar with the characteristics of the currency you are buying. For example, the Australian Dollar will benefit from rising commodity prices, the Canadian Dollar has a positive correlation with oil prices and so on.

One way to learn to trade forex is to open up a demo account and try it out. Our forex indices are a collection of related, strategically-selected pairs, grouped into a single basket. Trade on our 12 baskets of FX pairs, including the CMC USD Index and CMC GBP Index. Forex position trading is more suited for those who cannot dedicate hours each day to trading but have an acute understanding of market fundamentals. There are 198 trades, the average gain per trade is 0.64%, the win ratio is 75%, the max drawdown is 14%, and the profit factor is 3.1.

What If You Only Took 4 Trades a Month?

In that sense, you can say that traders help create the patterns found in market prices. Support and resistance levels may serve as potential profit targets. That is, traders would choose the closest support level for a short trade and the nearest resistance level for a long trade. As explained, the conventional basket trading method involves selecting a basket of currency pairs based on the currency pair that presents the clearest trend.

Participating in forex trading presents an opportunity to take part in a global marketplace with significant potential. Due to its popularity with day traders, forex has even gained a reputation for turning quick profits. In truth, it’s just as complex and competitive as any other world marketplace. To not only succeed but also succeed consistently, you need to understand the market and hone your trading strategy. The process of devising Forex trading strategies becomes simpler when you can make decisions based on trends. Technical Analysis is based on knowledge about price movements, volumes and price action of past behavior of the markets.

When you highlight the price structure (as in the USD/JPY trade example) we can clearly see the crookedness of Quasimodo. Now let me share with you a simple but effective trading trick. Break in the market structure – price start to make higher high HH. Break in the market structure – price start to make lower lows LL. The Quasimodo pattern works based on the imbalance between the supply and demand forces. The existence of the prevailing trend gives us the opportunity to either catch an entirely new trend or at least we get the chance to profit from a temporary retracement.